TOPEKA, Kan. — Federal judges in Kansas and Missouri on Monday together blocked much of a Biden administration student loan repayment plan that provides a faster path to cancellation and lower monthly payments for millions of borrowers.

The judges’ rulings prevent the U.S. Department of Education from helping many of the intended borrowers ease their loan repayment burdens going forward under a rule set to go into effect July 1. The decisions do not cancel assistance already provided to borrowers.

In Kansas, U.S. District Judge Daniel Crabtree ruled in a lawsuit filed by the state’s attorney general, Kris Kobach, on behalf of his state and 10 others. In his ruling, Crabtree allowed parts of the program that allow students who borrowed $12,000 or less to have the rest of their loans forgiven if they make 10 years’ worth of payments, instead of the standard 25.

But Crabtree said that the Department of Education won’t be allowed to implement parts of the program meant to help students who had larger loans and could have their monthly payments lowered and their required payment period reduced from 25 years to 20 years.

In Missouri, U.S. District Judge John Ross’ order applies to different parts of the program than Crabtree’s. His order says that the U.S. Department of Education cannot forgive loan balances going forward. He said the department still could lower monthly payments.

Ross issued a ruling in a lawsuit filed by Missouri Attorney General Andrew Bailey on behalf of his state and six others.

Together, the two rulings, each by a judge appointed by former President Barack Obama, a Democrat, appeared to greatly limit the scope of the Biden administration’s efforts to help borrowers after the U.S. Supreme Court last year rejected the Democratic president’s first attempt at a forgiveness plan. Both judges said Education Secretary Miguel Cardona exceeded the authority granted by Congress in laws dealing with students loans.

Bailey and Kobach each hailed the decision from their state’s judge as a major legal victory against the Biden administration and argue, as many Republicans do, that forgiving some students’ loans shifts the cost of repaying them to taxpayers.

“Only Congress has the power of the purse, not the President,” Bailey said in a statement. “Today’s ruling was a huge win for the rule of law, and for every American who Joe Biden was about to force to pay off someone else’s debt.”

The White House said it strongly disagrees with the judges’ rulings and would continue to defend the program, and use every available tool to give relief to students and borrowers.

In a statement, White House press secretary Karine Jean-Pierre said the Biden administration “will never stop fighting for students and borrowers — no matter how many roadblocks Republican elected officials and special interests put in our way.”

In a statement posted on the social media platform X, leaders of the Student Borrower Protection Center, which advocates for eliminating student debt, called the decisions “partisan lawfare” and “a recipe for chaos across the student loan system.”

“Millions of borrowers are now in limbo as they struggle to make sense of their rights under the law and the information being provided by the government and their student loan companies,” said the group’s executive director, Mike Pierce.

In both lawsuits, the suing states sought to invalidate the entire program, which the Biden administration first made available to borrowers in July 2023, and at least 150,000 have had their loans canceled. But the judges noted that the lawsuits weren’t filed until late March in Kansas and early April in Missouri.

“So the court doesn’t see how plaintiffs can complain of irreparable harm from them,” Crabtree wrote in his opinion.

Both orders are preliminary, meaning the injunctions imposed by the judges would remain in effect through a trial of the separate lawsuits. However, to issue a temporary order each judge had to conclude that the states were likely to prevail in a trial.

Kobach framed the Biden plan as “unconstitutional” and an affront to “blue collar Kansas workers who didn’t go to college.”

There was some irony in Crabtree’s decision: Kansas is no longer a party to the lawsuit Kobach filed. Earlier this month, Crabtree ruled that Kansas and seven other states in the lawsuit — Alabama, Idaho, Iowa, Lousiana, Montana, Nebraska and Utah — couldn’t show that they’d been harmed by the new program and dismissed them as plaintiffs.

That left Alaska, South Carolina and Texas, and Crabtree said they could sue because each has a state agency that services student loans.

But Crabtree said that lowering monthly payments and shortening the period of required payments to earn loan forgiveness “overreach any generosity Congress has authorized before.”

In the Missouri ruling, Ross said repayment schedules and “are well within the wheelhouse” of the department but the “plain text” of U.S. law doesn’t give it authority to forgive loans before 25 years of payments.

Missouri also has an agency that services student loans. The other states in its lawsuit are Arkansas, Florida, Georgia, North Dakota, Ohio and Oklahoma.

___ This story has been updated to clarify that while the judges decisions together block much of the Biden plan, some borrowers still could see their loan repayment burdens eased going forward.

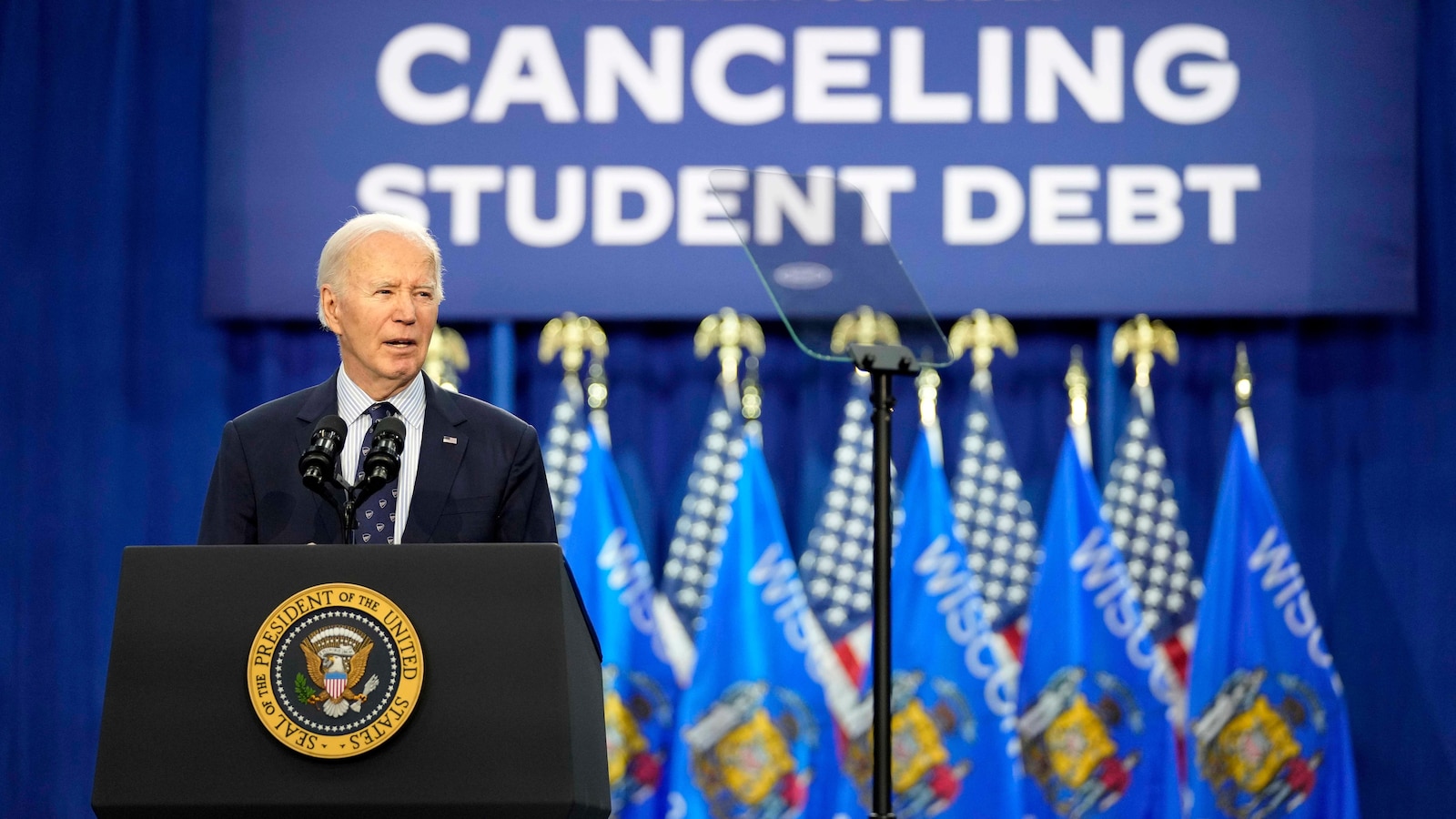

In a recent development, judges in Missouri and Kansas have issued temporary halts to President Biden’s student debt forgiveness plan. This decision comes as a blow to many borrowers who were hopeful that the plan would provide relief from their mounting student loan debt.

The temporary halts were issued in response to lawsuits filed by several states challenging the legality of President Biden’s plan to forgive up to $10,000 in student loan debt per borrower. The judges in Missouri and Kansas have expressed concerns about the constitutionality of the plan and have put a pause on its implementation until further legal proceedings can take place.

The decision to halt the student debt forgiveness plan has sparked a heated debate among lawmakers, borrowers, and advocacy groups. Supporters of the plan argue that it is a necessary step to help alleviate the burden of student loan debt on millions of Americans, especially in the midst of an ongoing pandemic that has exacerbated financial hardships for many.

Opponents of the plan, on the other hand, argue that it is an overreach of executive authority and could set a dangerous precedent for future administrations. They also raise concerns about the potential cost of forgiving billions of dollars in student loan debt and the impact it could have on the economy.

While the legal battle over President Biden’s student debt forgiveness plan continues to unfold, borrowers are left in limbo, unsure of what the future holds for their financial well-being. Many are anxiously awaiting a resolution to the legal challenges so they can finally receive some relief from their student loan debt.

In the meantime, borrowers are encouraged to stay informed about the latest developments in the case and to explore other options for managing their student loan debt, such as income-driven repayment plans, loan consolidation, or loan forgiveness programs for public service workers.

Ultimately, the outcome of the legal challenges to President Biden’s student debt forgiveness plan will have far-reaching implications for millions of borrowers across the country. It remains to be seen whether the plan will ultimately be implemented or if it will be struck down by the courts. In the meantime, borrowers are left to navigate a complex and uncertain landscape when it comes to managing their student loan debt.