The number of Americans applying for unemployment benefits rose modestly last week but remains at healthy levels.

The Labor Department reported Thursday that applications for jobless claims rose by 6,000 to 225,000 for the week of Sept. 28. It was slightly more than the 221,000 analysts were expecting.

The four-week average of claims, which evens out some of weekly volatility, fell by 750 to 224,250.

Applications for jobless benefits are widely considered representative of U.S. layoffs in a given week.

Recent labor market data has signaled that high interest rates may finally be taking a toll on the labor market.

In response to weakening employment data and receding consumer prices, the Federal Reserve last month cut its benchmark interest rate by a half of a percentage point as the central bank shifts its focus from taming inflation toward supporting the job market. The Fed’s goal is to achieve a rare “soft landing,” whereby it curbs inflation without causing a recession.

It was the Fed’s first rate cut in four years after a series of rate hikes in 2022 and 2023 pushed the federal funds rate to a two-decade high of 5.3%.

Inflation has retreated steadily, approaching the Fed’s 2% target and leading Chair Jerome Powell to declare recently that it was largely under control.

During the first four months of 2024, applications for jobless benefits averaged just 213,000 a week before rising in May. They hit 250,000 in late July, supporting the notion that high interest rates were finally cooling a red-hot U.S. job market.

U.S. employers added a modest 142,000 jobs in August, up from a paltry 89,000 in July, but well below the January-June monthly average of nearly 218,000. September’s jobs report is due out Friday.

Last month, the Labor Department reported that the U.S. economy added 818,000 fewer jobs from April 2023 through March this year than were originally reported. The revised total was also considered evidence that the job market has been slowing steadily, compelling the Fed to start cutting interest rates.

Thursday’s report said that the total number of Americans collecting jobless benefits was down by 1,000 to about 1.83 million for the week of Sept. 21.

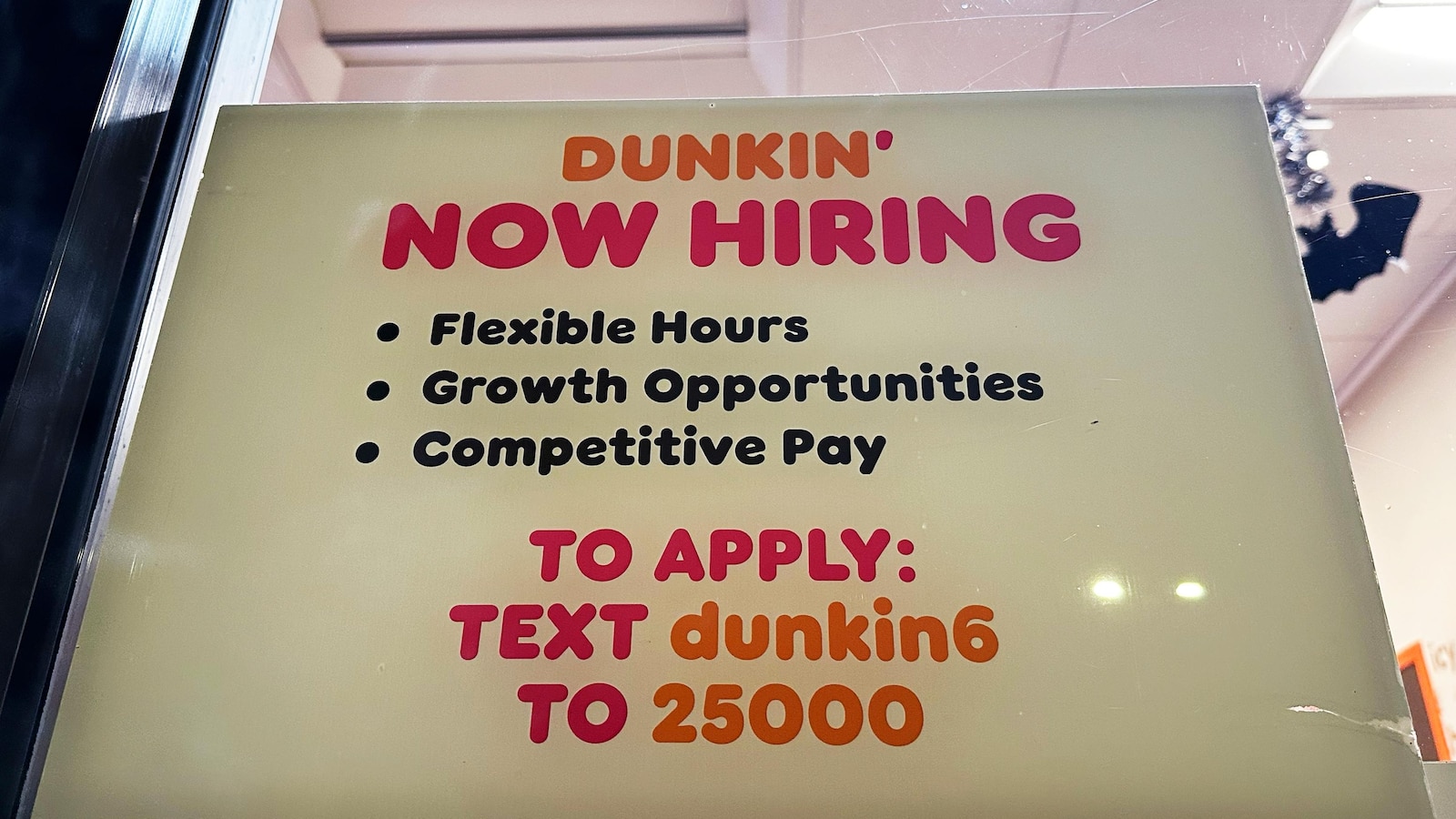

Separately on Thursday, some retailers said they are ramping up hiring for the holiday season, but fewer seasonal employees are expected to be taken on this year.

Despite historically low layoffs, the number of Americans filing for unemployment benefits increased last week. This unexpected rise has raised concerns about the state of the economy and the impact of ongoing global events on the job market.

According to the latest data released by the Labor Department, 230,000 Americans filed for unemployment benefits last week, an increase of 11,000 from the previous week. This marks the highest number of new claims since early September, when the effects of Hurricane Ida were still being felt.

While the overall trend in jobless claims has been downward in recent months, this recent uptick is a cause for concern. Economists had expected a decrease in unemployment filings as businesses continued to reopen and hire more workers. However, the rise in claims suggests that there may be underlying issues in the labor market that are not being addressed.

One possible explanation for the increase in unemployment filings is the ongoing supply chain disruptions and labor shortages that have been plaguing many industries. The global pandemic has caused disruptions in production and distribution networks, leading to shortages of goods and services. This, in turn, has put pressure on businesses to cut costs and reduce their workforce, leading to layoffs and job losses.

Another factor that may be contributing to the rise in unemployment claims is the expiration of federal pandemic relief programs. Many Americans who were receiving enhanced unemployment benefits during the height of the pandemic are now facing a sudden loss of income as these programs come to an end. This has forced many individuals to re-enter the job market and file for traditional unemployment benefits.

The increase in unemployment filings is a troubling sign for the economy, as it suggests that the recovery may not be as strong or as sustainable as previously thought. It also highlights the need for policymakers to take action to address the underlying issues that are driving job losses and economic instability.

In conclusion, while layoffs may be historically low, the increase in Americans filing for unemployment benefits last week is a cause for concern. It underscores the fragility of the current economic recovery and the need for targeted interventions to support workers and businesses during this challenging time.