Inflation data set to be released on Thursday will show whether price increases have continued a monthslong slowdown or hit a snag as they near normal levels.

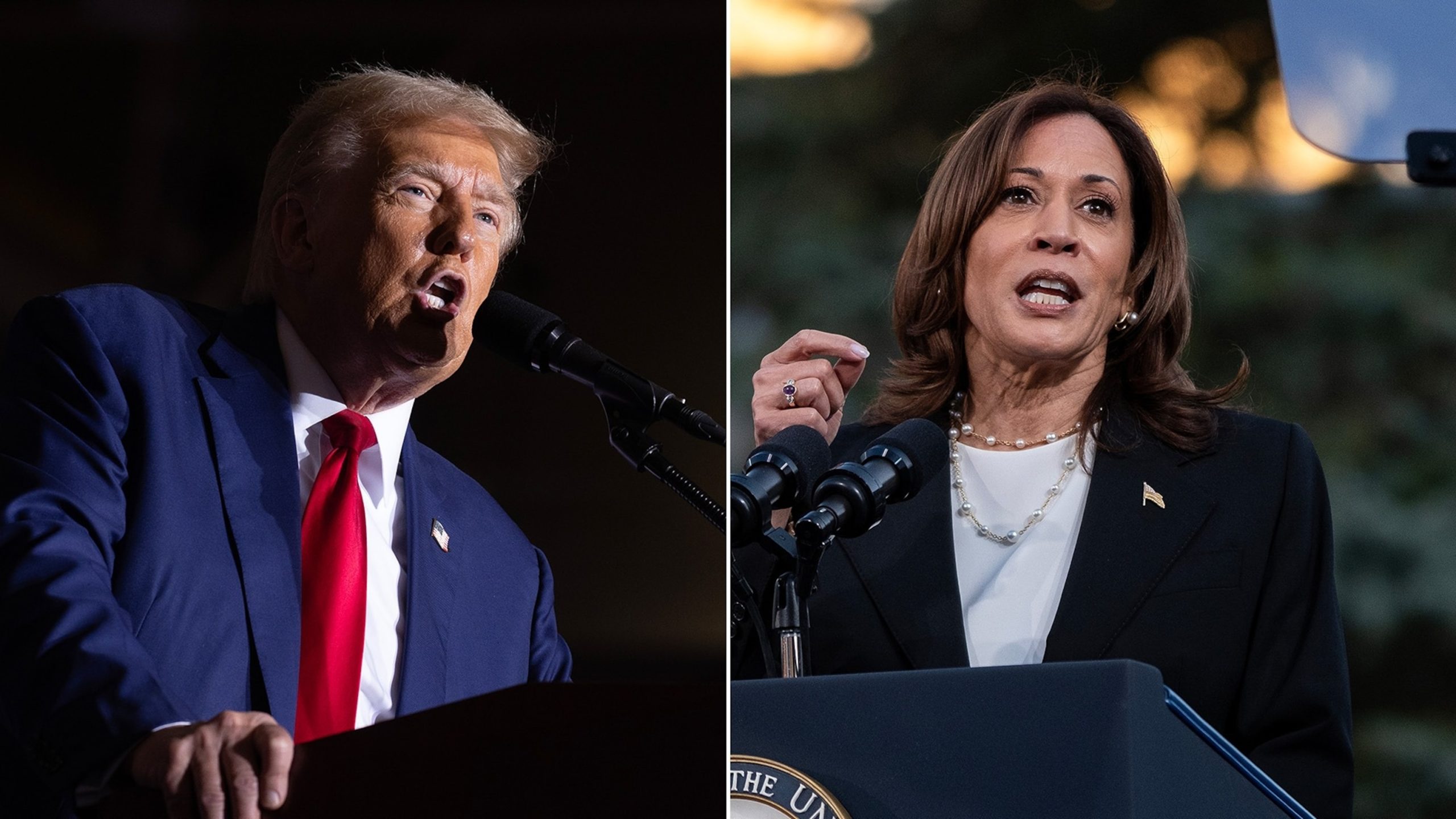

The report will mark the final update of the nation’s preeminent inflation gauge ahead of the presidential election next month. Price increases have proven a major point of contention between Vice President Kamala Harris and former President Donald Trump.

Inflation has slowed dramatically from a peak of about 9% in 2022, hovering right near the Federal Reserve’s target rate of 2%.

Economists expect prices to have climbed 2.3% over the year ending in September. That figure would mark a gradual slowdown from a 2.5% inflation rate recorded over the prior month.

The data is set to arrive about three weeks after the Federal Reserve cut its benchmark interest rate a half of a percentage point. The move dialed back the central bank’s yearslong inflation fight, signaling a shift toward greater focus on ensuring a strong labor market.

“This recalibration of our policy stance will help maintain the strength of the economy and the labor market,” Fed Chair Jerome Powell said at a press conference in Washington, D.C., last month.

Weaker-than-expected jobs data in both July and August had stoked worry among some economists about the nation’s economic outlook.

But a jobs report last week defied any such concern by presenting a rosy picture of the labor market for September in which employers hired at a strong pace, a large share of people stayed on the job and wages rose at a fast rate.

Employers hired 254,000 workers in September, far exceeding economist expectations of 150,000 jobs added, U.S. Bureau of Labor Statistics data showed.

Federal Reserve Board Chairman Jerome Powell holds a press conference following a two-day meeting of the Federal Open Market Committee on interest rate policy in Washington, D.C., Sept. 18, 2024.

Tom Brenner/Reuters

In theory, interest rate cuts stimulate economic activity and boost hiring. However, the Fed’s interest rate decisions typically take several months before they influence economic activity. In any case, the latest jobs report tracked hiring for September, meaning the majority of the period reflected in the data took place before the rate cut.

Consumer prices have received close scrutiny with just four weeks left until Election Day.

A decline in gas prices is expected to help nudge inflation downward. The average price of a gallon of gas is about 15% lower than where it stood a year ago, AAA data shows.

But an escalation of conflicts in the Middle East in recent weeks has triggered a sharp increase in oil prices, raising the possibility of a hike in gasoline prices over the coming days and weeks.

A cooldown of inflation would likely increase the chances of an interest rate cut at the Federal Reserve’s meeting on Nov. 7, just days after Election Day. On the other hand, an acceleration of price increases is expected to lower the chances of a rate cut.

Prior to the inflation data release, the odds of a quarter-point interest rate cut next month stood at about 80%, according to the CME FedWatch Tool, a measure of market sentiment.

Inflation is a key economic indicator that measures the rate at which prices for goods and services rise over a period of time. It is an important factor in determining the overall health of an economy and can have significant impacts on consumers, businesses, and policymakers. As such, analyzing inflation data is crucial for understanding the current state of the economy and making informed decisions.

One recent trend that has caught the attention of economists and analysts is the cooling of inflation leading up to the upcoming election. Inflation has been a hot topic in recent months, with prices rising at a rapid pace due to a variety of factors such as supply chain disruptions, increased demand, and rising energy costs. However, there are signs that this trend may be starting to reverse, with some indicators showing a slowdown in price increases.

One key indicator to watch is the Consumer Price Index (CPI), which measures the average change in prices paid by consumers for goods and services. In recent months, the CPI has shown signs of slowing down, with inflation rates moderating compared to earlier in the year. This could be a positive sign for consumers, as it may indicate that prices are starting to stabilize and not rise as quickly.

Another important factor to consider is the Producer Price Index (PPI), which measures the average change in prices received by producers for their goods and services. Like the CPI, the PPI has also shown signs of cooling in recent months, with inflation rates starting to level off. This could be a positive sign for businesses, as it may indicate that input costs are starting to stabilize and not rise as quickly.

There are several reasons why inflation may be cooling leading up to the election. One possible explanation is that the initial surge in prices earlier in the year was driven by temporary factors such as supply chain disruptions and pent-up demand. As these factors start to normalize, prices may start to stabilize and not rise as quickly.

Another possible explanation is that policymakers have taken steps to address inflationary pressures, such as tightening monetary policy or implementing supply chain reforms. These actions may be starting to have an impact on inflation rates, leading to a slowdown in price increases.

It is important to note that while inflation may be cooling leading up to the election, it is still a key economic indicator to watch. Inflation can have significant impacts on consumers, businesses, and policymakers, and understanding its trends and drivers is crucial for making informed decisions.

In conclusion, the analysis of inflation data leading up to the election shows signs of a cooling trend in prices. This could be a positive sign for consumers and businesses, as it may indicate that prices are starting to stabilize and not rise as quickly. However, it is important to continue monitoring inflation data closely to understand its trends and drivers and make informed decisions in response.