A federal appeals court blocked the Biden administration’s new student loan relief plan, known as SAVE, on Thursday.

The 8th Circuit Court of Appeals said in a ruling it would grant a request by Republican-led states to put the full program’s implementation on hold.

Parts of the plan were already blocked by a lower court last month.

Eight million people have enrolled in SAVE, including 4.5 million borrowers who have a zero-dollar payment each month, according to the White House. The repayment plan seeks to lower monthly payments by tying bills to a borrower’s income.

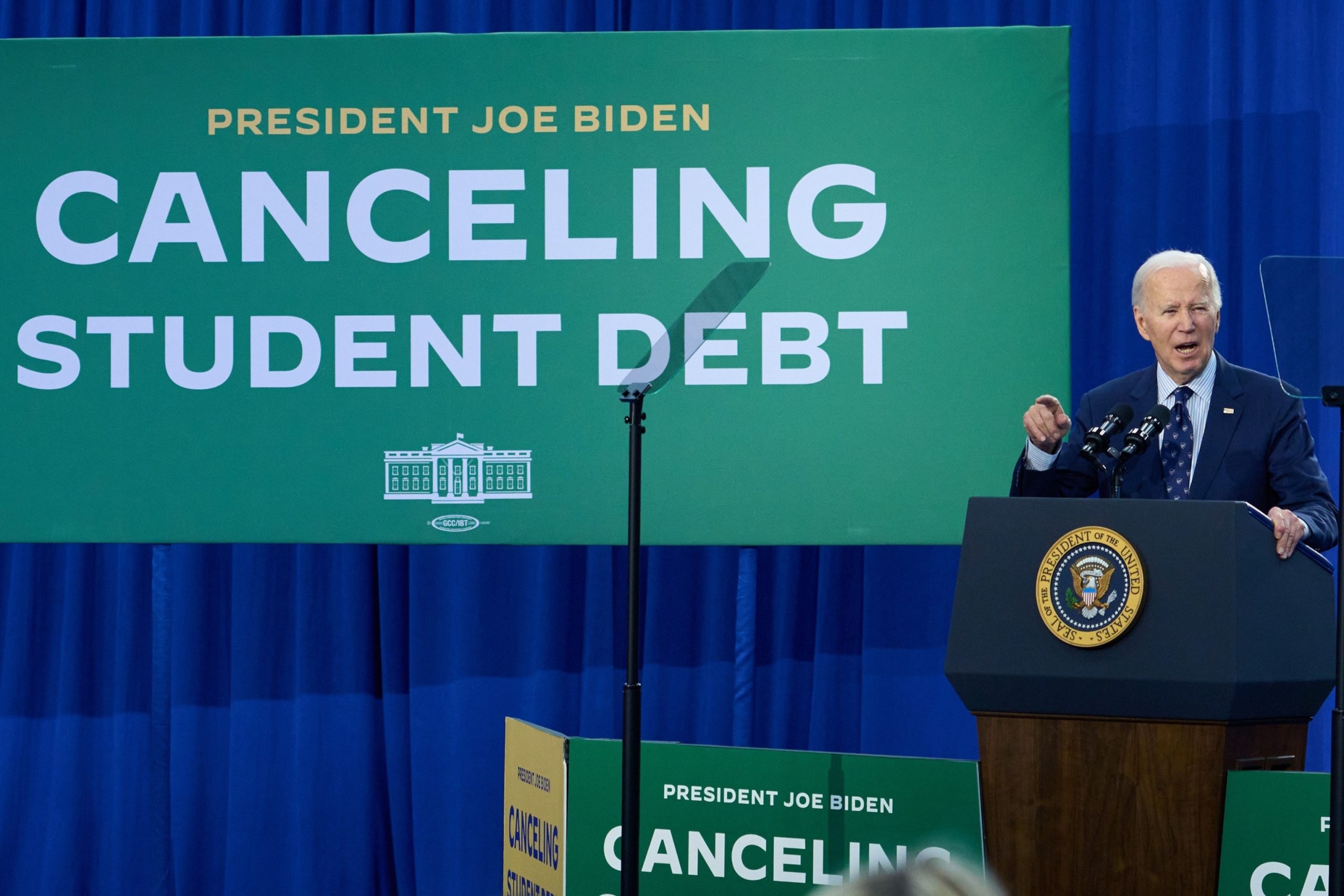

In this April 8, 2024, file photo, President Joe Biden speaks during an event in Madison, Wisconsin.

Bloomberg via Getty Images, FILE

“We are assessing the impacts of this ruling and will be in touch directly with borrowers with any impacts that affect them. Our Administration will continue to aggressively defend the SAVE Plan.…we won’t stop fighting against Republican elected officials’ efforts to raise costs on millions of their own constituents’ student loan payments,” White House spokesperson Angelo Fernández Hernández said in a statement to ABC News.

The SAVE plan has been in place for almost a year and is the jewel of Biden’s surviving student loan efforts — one that he has touted heavily in his reelection campaign.

On October 8, 2021, a federal appeals court dealt a blow to President Biden’s new student loan plan by blocking its implementation. The plan, which aimed to provide relief to millions of borrowers by expanding eligibility for loan forgiveness, was put on hold by the Fifth Circuit Court of Appeals in response to a lawsuit filed by several states.

The Biden administration’s new student loan plan sought to streamline the process for borrowers to have their loans forgiven if they were defrauded by their schools or if their schools closed. It also aimed to provide relief to borrowers who were misled by their schools about the value of their education or job prospects.

However, the states that filed the lawsuit argued that the new plan exceeded the Department of Education’s authority and would impose significant costs on taxpayers. They also claimed that the plan would unfairly benefit certain groups of borrowers over others.

In its ruling, the appeals court agreed with the states and issued a preliminary injunction blocking the implementation of the new student loan plan. The court found that the plan was likely to cause irreparable harm to the states and that the Department of Education had not followed proper procedures in issuing the new rules.

The Biden administration has expressed disappointment with the court’s decision and has vowed to continue fighting for student loan relief. Education Secretary Miguel Cardona stated that the administration remains committed to helping borrowers who have been defrauded by their schools and will explore other options to provide relief.

The ruling by the appeals court highlights the challenges facing the Biden administration as it seeks to address the student loan crisis in the United States. With over $1.7 trillion in outstanding student loan debt, millions of borrowers are struggling to make ends meet and are in need of relief.

As the legal battle over the new student loan plan continues, it is clear that finding a solution to the student loan crisis will require collaboration and cooperation between all stakeholders. It is crucial that policymakers work together to find a sustainable and equitable solution that provides relief to borrowers while also protecting taxpayers and ensuring accountability in the higher education system.