Lawyers for Washington state will have past grocery chain mergers – and their negative consequences – in mind when they go to court to block a proposed merger between Albertsons and Kroger.

The case is one of three challenging the $24.6 billion deal, which was announced nearly two years ago. The Federal Trade Commission is currently fighting the merger in federal court in Oregon, where closing arguments are expected Tuesday. Colorado has also sued to block the merger.

But if the merger goes through, Washington residents would feel the impact more than the people of any other state. Albertsons and Kroger own more than 300 grocery stores in the state and control more than half of grocery sales there.

Under a plan to ease regulators’ concerns, Kroger and Albertsons would sell 579 overlapping stores, 124 of them in Washington, if the merger goes through. That’s the highest number among the 19 states with stores on the list. The state attorney general’s office says the proposed buyer, C&S Wholesale Grocers, has little experience running stores or pharmacies.

Washington seeks to avoid the situation it found itself in a decade ago, when Albertsons bought the Safeway chain. To satisfy regulators concerned about that deal’s potential impact on supermarket competition and consumers, Albertsons sold 146 stores to Haggen, a small grocery chain based in Bellingham, Washington.

But Haggen struggled with the expansion. Within six months, it had closed 127 stores — including 14 in Washington — and laid off thousands of workers. Haggen sold its remaining stores to Albertsons in 2016. Now, 10 Haggen stores in Washington are on the list to be sold if the merger happens.

“It’s pretty terrifying,” said Tina McKim, a founding member of Birchwood Food Desert Fighters, a group that sprang up in 2016 after Albertsons closed a store in Bellingham’s Birchwood neighborhood.

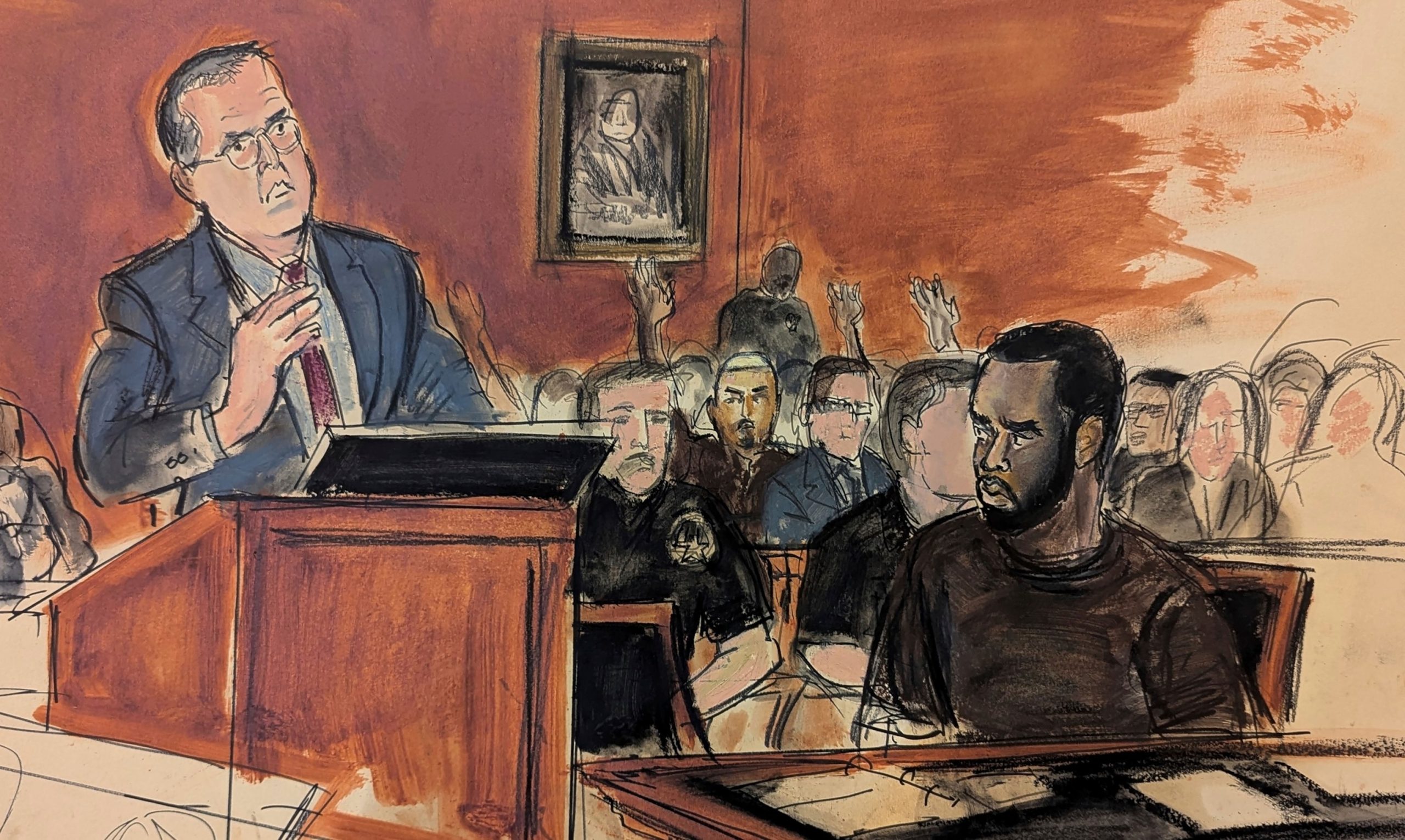

Washington Attorney General Bob Ferguson, a Democrat who is running for governor, wants to block the merger not just in the state but nationwide. In its complaint, filed in King County Superior Court in Seattle, Washington says eliminating the “robust competition” that exists between Albertsons and Kroger would lead to higher prices, lower quality and, most likely, store closures.

Albertsons and Kroger say the merger would help them better compete with growing rivals like Walmart and Costco. They are trying to get the case dismissed, arguing a state court isn’t the proper venue to consider a nationwide ban.

“Under our federalist system, Washington cannot wield its antitrust law to dictate merger policy for the rest of the country,” Albertsons and Kroger said in a court filing.

Brad Weber, a Dallas-based partner with the law firm Locke Lord who specializes in antitrust issues, said the Superior Court judge could decide to halt the merger nationwide or limit his ruling to Washington. Judge Marshall Ferguson might also order the companies to make changes to their plans to divest stores to preserve competition.

Ferguson may also decide to delay the case until there’s a ruling from the U.S. District Court in Oregon. Weber said. In that case, the Federal Trade Commission has asked a judge to temporarily block the merger until it is considered by an in-house judge at the FTC.

Albertsons and Kroger insist that their plan, including the sale of stores to C&S, will lower grocery prices and preserve competition. But Washington residents like McKim remain skeptical.

In 2016, Albertsons acquired a Haggen supermarket and then promptly closed an Albertsons store about a mile away in Birchwood. When it sold its former store two years later, Albertsons included a restriction: for the next 20 years, no grocery store could open in the Birchwood shopping plaza.

Albertsons says these types of restrictions — occasionally used when there is a store in close proximity to the store that’s closing — can help grocery companies stay competitive.

But it was a huge blow to the community, McKim said. For 35 years, the Birchwood store had served older adults, students, people with disabilities and lower-income residents who suddenly had no easy access to fresh food.

“We were all really shocked by that. How is it possible to deny food access to a neighborhood?” McKim said. “It made it really hard for anyone without a car to be able to go to another grocery store.”

McKim’s group tries to fill the void by collecting food donations and bringing in produce from local farms, but “it’s nowhere near the level of access people need,” she said.

This summer, after an investigation by Washington’s attorney general, Albertsons removed the restriction on the shopping plaza. A Big Lots that moved into the former grocery store is closing soon, McKim said, and she hopes the space will attract another supermarket. But even if it does, the community may never get back the unionized jobs it lost when Albertsons shut its doors, she said.

McKim said her area does have a Walmart, but it’s even further away from Birchwood than the Albertsons-run Haggen store, which is on the list of stores that would be sold to C&S. She’s also not convinced Kroger and Albertsons need to merge to compete with Walmart.

“This city is growing so quickly, the need for food is absolutely critical everywhere,” McKim said. “When you see other stores succeed, it’s because they curate to the neighborhood’s needs.”

In recent years, there has been a growing trend of grocery chain mergers in the United States as companies seek to increase their market share and compete more effectively in the highly competitive industry. One such merger that has been making headlines is the proposed deal between Albertsons and Kroger. However, this deal has hit a roadblock as several states have expressed opposition to the merger, citing concerns about its potential impact on competition and consumer choice.

Albertsons and Kroger are two of the largest grocery chains in the country, with a combined total of over 4,000 stores and annual revenues in the tens of billions of dollars. The proposed merger between the two companies would create a behemoth in the grocery industry, with a market share that could potentially give them significant pricing power and the ability to squeeze out smaller competitors.

Several states, including California, Texas, and Florida, have raised objections to the merger, arguing that it would reduce competition in the grocery market and lead to higher prices for consumers. In California, for example, the state’s attorney general has filed a lawsuit to block the merger, claiming that it would harm consumers by reducing competition and choice in the grocery industry.

Opponents of the merger also point to the potential impact on suppliers, who could face increased pressure to lower their prices in order to secure shelf space in the combined company’s stores. This could lead to a decrease in quality and variety of products available to consumers, as smaller suppliers may be unable to compete with larger companies that have more bargaining power.

On the other hand, supporters of the merger argue that it would allow Albertsons and Kroger to better compete with other major players in the industry, such as Walmart and Amazon. They claim that the combined company would be able to offer consumers a wider selection of products at lower prices, thanks to economies of scale and increased efficiency.

Despite the opposition from several states, Albertsons and Kroger remain committed to completing the merger. However, they may be forced to make concessions in order to address the concerns raised by regulators and secure approval for the deal. This could include selling off certain stores or making commitments to maintain competition in specific markets.

In conclusion, the opposition to the proposed merger between Albertsons and Kroger highlights the complex dynamics at play in the grocery industry. While consolidation can bring benefits such as increased efficiency and lower prices for consumers, it also raises concerns about reduced competition and potential harm to suppliers. It remains to be seen how this situation will ultimately play out, but one thing is clear: the outcome of this merger could have far-reaching implications for the future of the grocery industry in the United States.