An escalation of conflicts in the Middle East in recent weeks has triggered a sharp increase in oil prices, raising uncertainty about where costs will head in the final weeks before Election Day.

Oil prices surged about 13% over an 11-day stretch ending on Monday. Prices fell markedly on Tuesday, however, as nearly a week passed without the onset of a widely anticipated Israeli counterattack on Iran.

The rise of oil prices carries potential implications for the presidential election next month. A hike in the cost of crude oil typically raises the price of gasoline, which holds substantial sway over general consumer attitudes, experts told ABC News.

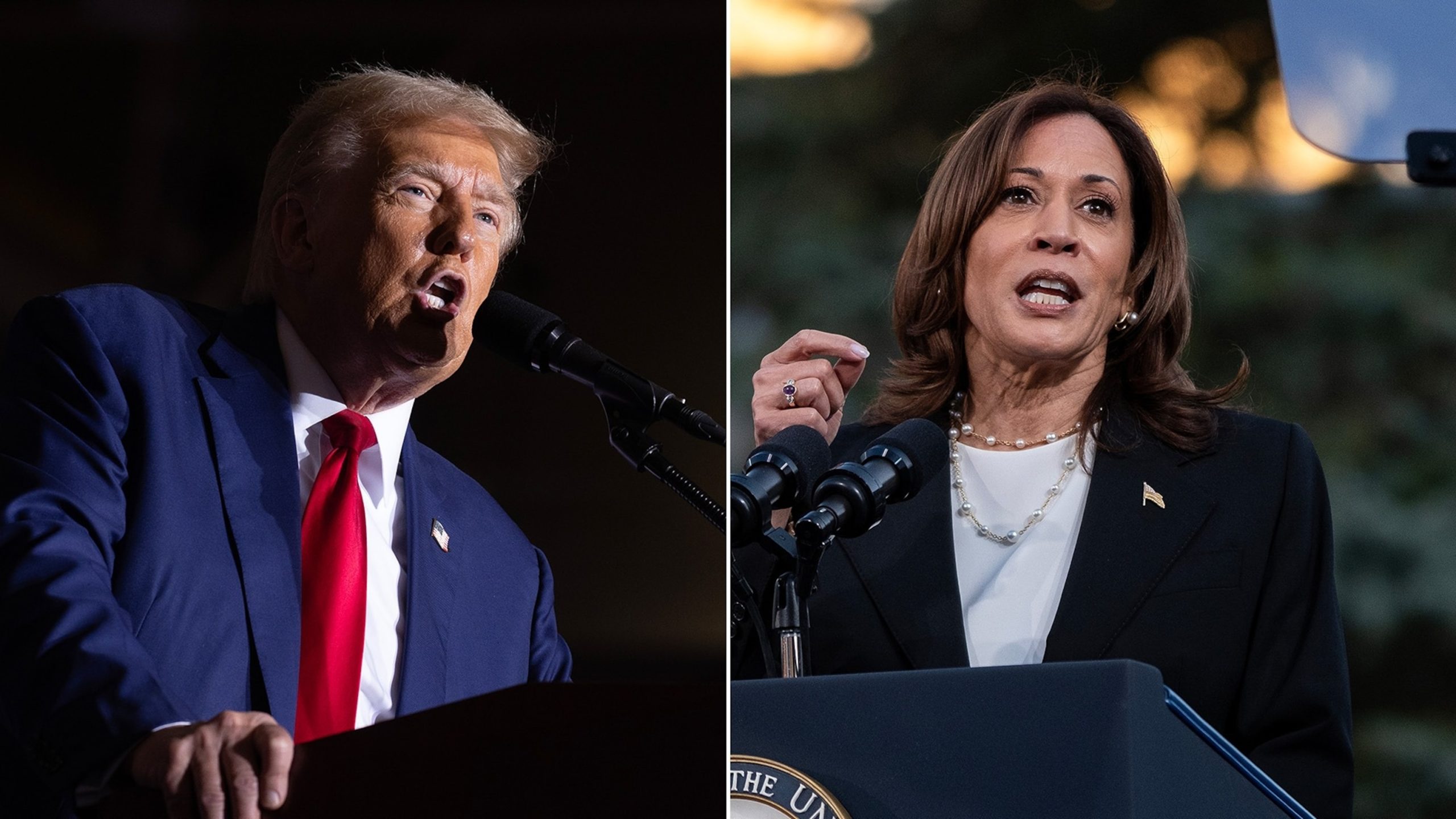

For now, the recent increase in oil prices is not large enough to impact the election, experts said. However, they added, a further spike over the coming weeks could sour consumer sentiment and weaken approval of Vice President Kamala Harris, since her party occupies the White House.

“People use gasoline as a gauge of the economy and how they’re feeling about it,” Denton Cinquegrana, chief oil analyst at the Oil Price Information Service, told ABC News.

“A small change in prices probably won’t move the needle. If the price of a gallon goes up 50 cents, then that gets people’s attention,” Cinquegrana added, noting that such an increase is possible, but unlikely.

At least one expert cast doubt over the impact of even a sharp hike in oil and gas prices, saying it is unclear whether voters would fault Harris for the price spike and, even if they did, whether the few weeks remaining in the campaign affords enough time for higher prices to register with voters.

“People look at the economy over the long term, not the last month,” Jon Krosnick, a professor of political science at Stanford University who studies the relationship between gas prices and political perceptions, told ABC News.

In the aftermath of the Iranian attack on Israel last week, petroleum analysts told ABC News that the resulting spike in oil prices could push up gasoline prices between 10 and 15 cents per gallon. An increase of that magnitude would not affect the election, experts said, since the moderate uptick would do little to irk consumers and diminish their opinion about the nation’s economy.

“I do suspect that prices are going to continue to move higher, but I don’t think it will be significantly higher,” Cinquegrana said. “Unless something really goes haywire, I don’t expect prices to spike ahead of the election.”

A slight increase in gas prices may not matter much to consumers because costs at the pump have eased significantly over the past year, experts said.

Fuel prices have plummeted in recent months due to sluggish demand for gas as the busy summer traveling season has given way to an autumn slowdown. The average price of a gallon of gas is about 15% lower than where it stood a year ago, AAA data shows.

Smoke rises in Beirut’s southern suburbs after a strike, amid the ongoing hostilities between Hezbollah and Israeli forces, as seen from Hadath, Lebanon, Oct. 8, 2024.

Mohamed Azakir/Reuters

Despite its recent uptick, the price of oil has also fallen from a 2022 peak reached when the blazing-hot economic rebound from the pandemic collided with a supply shortage imposed by the Russia-Ukraine war.

A major escalation of the conflict between Israel and Iran, however, could send oil and gas prices much higher, analysts said, pointing to potentially dire consequences of an anticipated retaliatory strike by Israel against Iran.

While sanctions have constrained Iranian oil output in recent years, the nation asserts control over the passage of tankers through the Strait of Hormuz, a trading route that facilitates the transport of about 15% of global oil supply.

Intensification of the war could limit Iranian oil production or transport through the Strait of Hormuz, cutting global supply and sending prices upward, some experts said.

“The risk of a wider war in the Middle East has gone up,” Jim Burkhard, vice president and head of research for oil markets, energy and mobility at S&P Global, told ABC News. “There’s the risk of something happening that could lead to higher prices.”

A further surge in oil prices would send gas prices skyrocketing, which could damage Harris’ political fortunes if voters fault the Biden administration for the sudden increase in costs right before they cast their ballots, Carola Binder, an economics professor at the University of Texas at Austin who studies the relationship between gas prices and consumer attitudes, told ABC News.

“If there was a huge increase in gas prices, I could imagine that hurting Harris’ chances,” Binder said. “Consumer sentiment does affect elections.”

Such a forecast drew sharp disagreement from Krosnick, even though his research helped establish an understanding of the political implications of rising gas prices.

Krosnick co-authored a 2016 study in the academic journal Political Psychology that examined the relationship between gas prices and presidential approval rating between the mid-1970s and mid-2000s. The study found that elevated gas prices drove a president’s approval downward. To be exact, each 10-cent increase in the gas price was associated with more than half a percentage point decline in presidential approval, the research showed.

The findings do not shed light on a scenario in which gas prices spike ahead of next month’s election, Krosnick said, noting that his research examined shifts in public opinion over a much longer period of time. Plus, he added, voters may not fault Harris for the Middle East conflict that would drive the potential price increase.

“There isn’t enough time for there to be a sustained change in prices,” Krosnick said. “It takes a while to ripple out to consumers.”

The recent escalation of tensions in the Middle East has once again put the spotlight on the impact of rising oil prices on election outcomes. As one of the world’s largest oil-producing regions, any conflict in the Middle East has the potential to disrupt global oil supplies and drive up prices. This can have far-reaching consequences on economies around the world, including those of major oil-importing countries like the United States.

Historically, rising oil prices have been associated with economic downturns and political instability. When consumers are forced to pay more at the pump, they have less disposable income to spend on other goods and services, leading to a slowdown in economic growth. This can have a negative impact on the incumbent government’s popularity and increase the chances of a change in leadership during an election year.

In the United States, for example, high oil prices have been linked to incumbent presidents losing re-election bids. The most notable example of this was during the 1980 presidential election when President Jimmy Carter lost to Ronald Reagan amid soaring oil prices caused by the Iranian Revolution. More recently, in 2012, President Barack Obama faced criticism for high gas prices during his re-election campaign, although he ultimately won a second term.

The current situation in the Middle East, with tensions between the United States and Iran escalating, has already led to a spike in oil prices. The assassination of Iranian General Qasem Soleimani in early January sent shockwaves through the oil market, causing prices to surge to their highest levels in months. If the conflict continues to escalate, it could lead to further disruptions in oil supplies and even higher prices at the pump.

For President Trump, who is up for re-election in November, rising oil prices could pose a significant challenge. While he has touted his administration’s efforts to boost domestic oil production and reduce dependence on foreign oil, a prolonged conflict in the Middle East could still have a negative impact on the economy and his approval ratings. This could potentially sway voters towards his Democratic challengers who may promise a different approach to foreign policy and energy security.

In conclusion, the impact of rising oil prices amid conflict in the Middle East on election outcomes cannot be underestimated. As history has shown, high oil prices can have a significant influence on voter sentiment and ultimately determine the outcome of an election. It will be interesting to see how the current situation plays out and whether it will have any bearing on the upcoming presidential election in the United States.