WASHINGTON — U.S. wholesale price increases mostly slowed last month, the latest evidence that inflation pressures are cooling enough for the Federal Reserve to begin cutting interest rates next week.

The Labor Department said Thursday that its producer price index — which tracks inflation before it reaches consumers — rose 0.2% from July to August. That was up from an unchanged reading a month earlier. But measured from a year ago, prices were up just 1.7% in August, the smallest such rise since February and down from a 2.1% annual increase in July.

Excluding food and energy prices, which tend to fluctuate from month to month, so-called core wholesale prices moved up 0.3% from July and have risen 2.3% from August 2023.

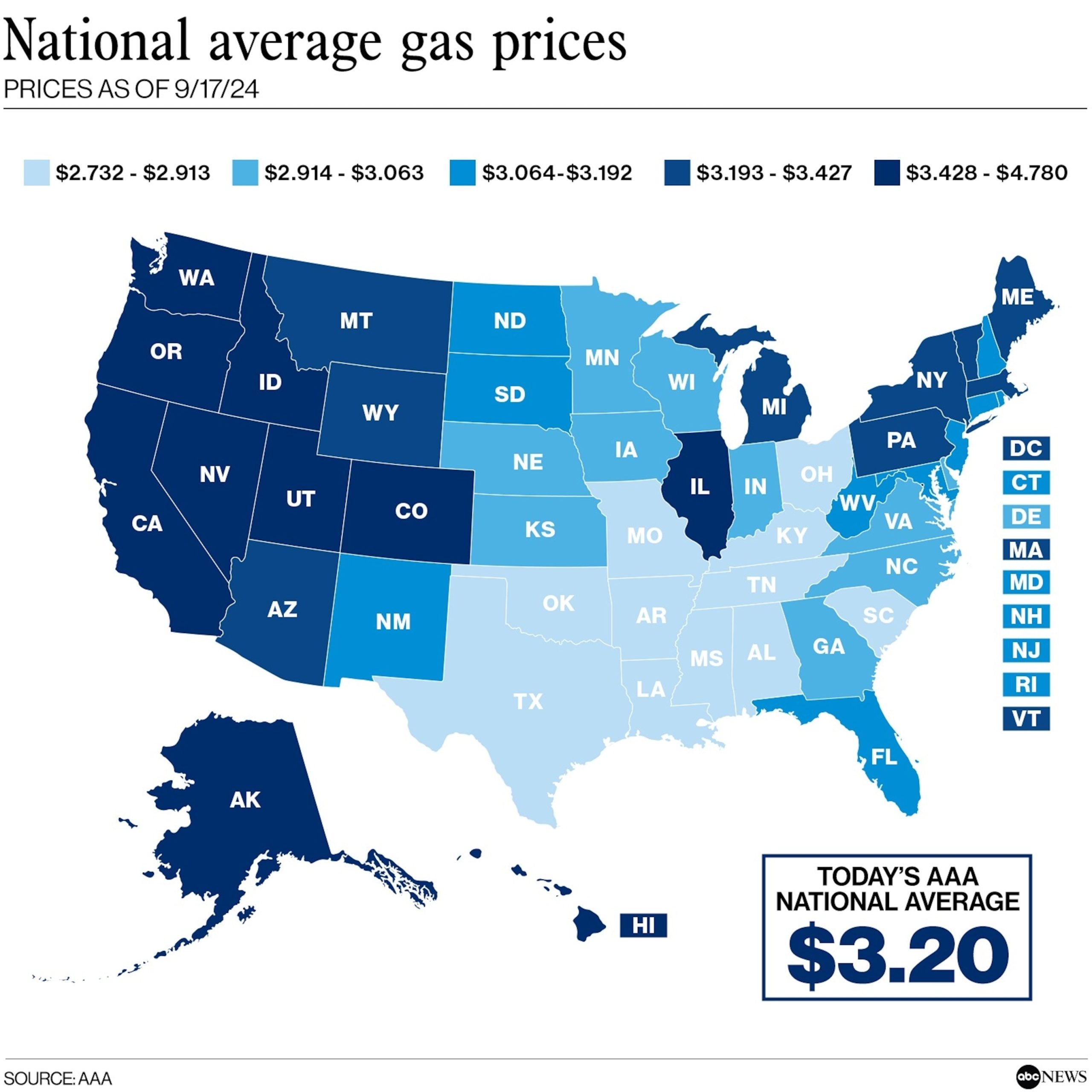

Taken as a whole, last month’s wholesale price figures suggest that inflation is moving back toward the Fed’s 2% target level. After peaking at a four-decade high in mid-2022, the prices of gas, groceries and autos are either falling or rising at slower pre-pandemic rates. On Wednesday, the government reported that its main inflation measure, the consumer price index, rose just 2.5% in August from a year earlier, the mildest 12-month increase in three years.

The pickup in core wholesale prices from July to August was driven by a 0.4% rise in the cost of services, such as internet access and banking.

Goods prices were unchanged from July to August, with the cost of energy falling 0.9%. Wholesale food prices ticked up just 0.1% last month and are down 0.8% compared with a year earlier, a sign that grocery store prices, though still up nearly 25% since the pandemic, are now barely increasing.

The latest inflation figures follow a presidential debate Tuesday night in which former President Donald Trump attacked Vice President Kamala Harris for the price spikes that began a few months after the Biden-Harris administration took office, when global supply chains seized up and caused severe shortages of parts and labor.

During the debate, Trump falsely characterized the scope of the inflation surge when he claimed that inflation during the Biden-Harris administration was the highest “perhaps in the history of our country.” In 1980, inflation reached 14.6% — much higher than the 2022 peak of 9.1%.

The producer price index can provide an early sign of where consumer inflation is headed. Economists also watch it because some of its components, notably healthcare and financial services, flow into the Fed’s preferred inflation gauge — the personal consumption expenditures, or PCE, index.

In its fight against high inflation, the Fed raised its benchmark interest rate 11 times in 2022 and 2023, taking it to a 23-year high. With inflation now close to their target level, the Fed’s policymakers are poised to begin cutting their key rate from its 23-year high in hopes of bolstering growth and hiring.

A modest quarter-point cut is widely expected to be announced after the central bank meets next week. Over time, a series of rate cuts should reduce the cost of borrowing across the economy, including for mortgages, auto loans and credit cards.

Other central banks in advanced economies such as Canada, Switzerland, and the United Kingdom have already cut rates. On Thursday, the European Central Bank reduced its benchmark rates for a second time this year, as both inflation and economic growth are cooling.

Wholesale inflation, also known as producer price inflation, is a key indicator of the overall health of an economy. It measures the change in prices that producers receive for their goods and services before they are passed on to consumers. The latest data on wholesale inflation shows that price pressures are cooling, indicating a potential slowdown in overall inflation.

According to the Bureau of Labor Statistics, wholesale prices rose by 0.2% in September, which was lower than the 0.6% increase seen in August. This marks the smallest increase in wholesale prices since May, suggesting that inflationary pressures may be easing.

One of the main drivers behind the cooling wholesale inflation is a decline in energy prices. The cost of energy products fell by 0.7% in September, following a 5.6% increase in August. This drop in energy prices has helped to offset some of the price increases seen in other sectors of the economy.

Another factor contributing to the slowdown in wholesale inflation is weakening demand for goods and services. With the global economy facing uncertainties such as trade tensions and geopolitical risks, businesses are becoming more cautious in their spending, leading to softer demand for products and services.

The Federal Reserve closely monitors inflation data as part of its mandate to maintain price stability and full employment. The latest data showing cooling wholesale inflation may give the Fed more room to pause its interest rate hikes, as lower inflationary pressures could alleviate concerns about overheating in the economy.

While cooling wholesale inflation may be seen as a positive development for consumers, it is important to note that it is just one piece of the puzzle when it comes to assessing overall economic health. Other factors such as wage growth, consumer spending, and business investment also play a crucial role in determining the direction of the economy.

In conclusion, the latest data on wholesale inflation showing a cooling trend indicates that price pressures may be easing, providing some relief for businesses and consumers. However, it is important for policymakers to continue monitoring economic indicators closely to ensure that the economy remains on a stable growth path.