Handing the Biden administration an unexpected win amidst a legal back-and-forth, a court over the weekend agreed to let the Education Department continue implementing the final phases of a student loan repayment plan that will lower people’s monthly bills.

This comes after the department had already begun the process to put 3 million borrowers into a payment pause, a move officials said was necessary to comply with the court’s initial ruling last week to halt the payment cuts. But because of the latest ruling, borrowers enrolled in the SAVE Plan will now go forward with payments at their new rates beginning in July and August, officials said.

The SAVE Plan, dubbed the most affordable plan for borrowers and President Joe Biden’s hallmark surviving student debt reform effort, is the target of two Republican-led lawsuits that argue the Biden administration has gone beyond its authority in aspects of the plan. Courts in Kansas and Missouri ruled in the GOP states’ favor last week, deciding the Biden administration could not go forward with further implementation of the SAVE Plan, an income-driven repayment plan that was rolled out last August and used by 8 million people.

In particular, the rulings halted the Department of Education from cutting borrowers’ payments beginning July 1, when they were set to decrease from 10% of a borrower’s discretionary income down to 5% for those with undergraduate loans, and from canceling any more loans for people who’d taken out small initial loan balances but had been paying them down for over a decade. So far, 414,000 people have qualified for the debt relief.

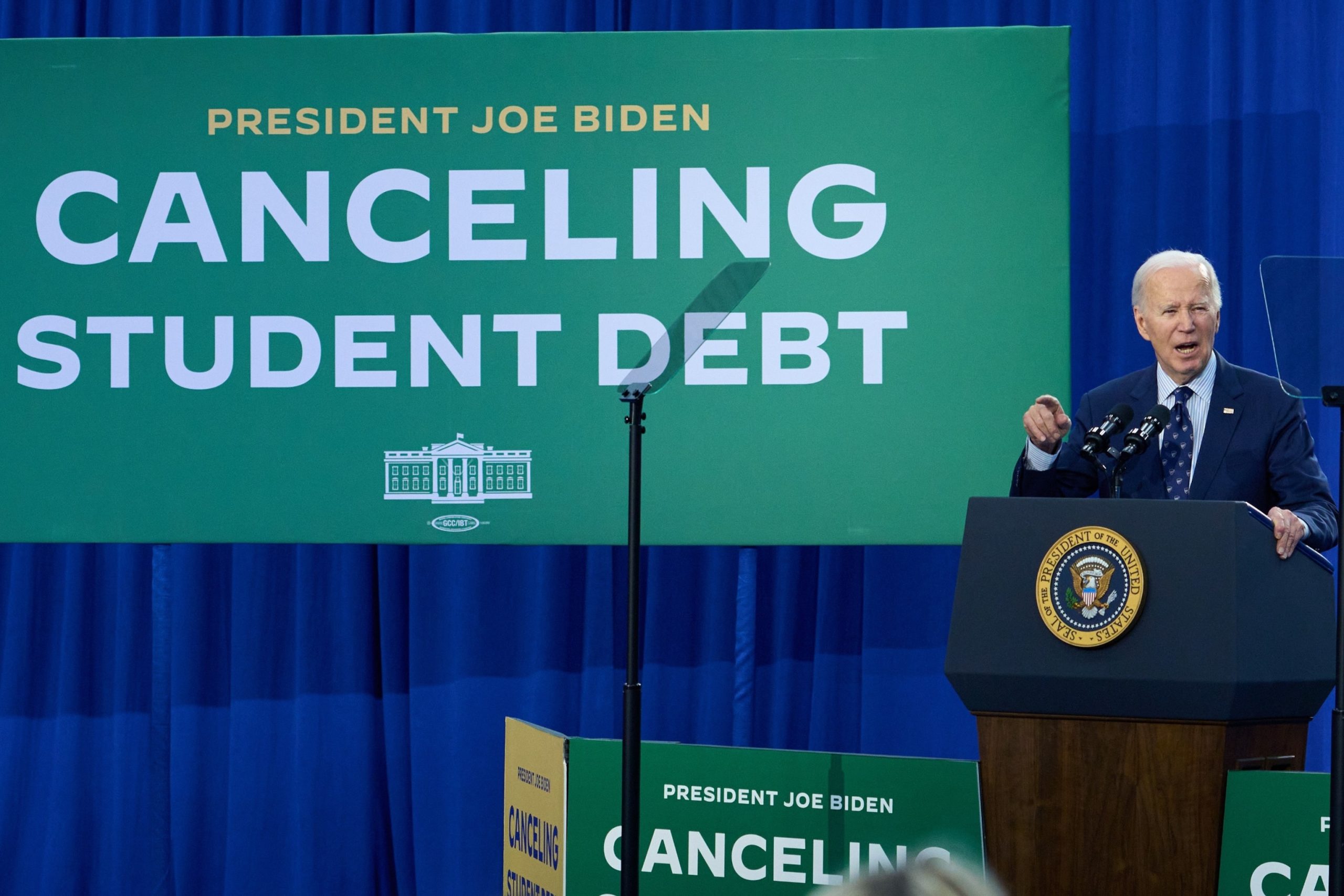

U.S. President Joe Biden speaks during an event in Madison, Wisconsin, on Monday, April 8, 2024. (PHOTO: Daniel Steinle/Bloomberg via Getty Images)

Bloomberg via Getty Images

After the Department of Justice filed an emergency motion on Friday, the U.S. Court of Appeals for the 10th Circuit reversed the lower court’s ruling, allowing the Biden administration to proceed with the payment cut. Debt relief remains on pause.

“Yesterday, the U.S. Court of Appeals for the Tenth Circuit sided with student loan borrowers across the country who stand to benefit from the SAVE Plan – the most affordable repayment plan in history,” Education Department Secretary Miguel Cardona said in a statement on Monday.

In addition to offering the lowest monthly payment for most borrowers, the plan also shields borrowers from unpaid interest accrual, one of the largest additional fees that borrowers face on their loans. Unpaid interest is forgiven so long as qualified borrowers make their monthly payments on the loan – even if their required payment is $0. About 4.5 million borrowers enrolled in the SAVE Plan qualify for $0 monthly payments because they make minimum wage or less.

“Borrowers will hear directly from their loan servicers and the Department as we implement the new, lower monthly payments for borrowers enrolled in SAVE,” Cardona said.

The department offered some guidance for borrowers trying to navigate the rulings.

Due to the rush to adhere to evolving court decrees, some borrowers might have already been placed on a payment pause when the court reversed the ruling. Those borrowers – who should see in their student loan servicer portals that they are placed in forbearance – will remain on a payment pause through July and be expected to make their first payment at the lower rate in August, a Department of Education spokesperson said Monday.

If a borrower has already received a bill from their loan servicer with a lower, correct rate, they should expect to pay it in July, the spokesperson said.

Overall, following the changes has been challenging, said Michael Lopez, a 33-year-old social worker and high school wrestling coach who lives in Anaheim, California. Lopez took on roughly $200,000 to get an undergraduate and then a master’s degree in social work, putting him on the high end of the spectrum of student debt carried by Americans.

“I’ve been keeping up as best I can, given all of the sudden shifts,” he said. Lopez said he was relieved to see that the SAVE Plan could go forward and his monthly payments would fall but that the pattern of court decisions halting student loan policies has made him permanently wary.

“I’m happy about it and at the same time still anxious over the whole thing. There have been so many changes and so much uncertainty that it’s hard to really feel great about any good news since it could easily change again,” Lopez said.

Lopez and many other borrowers were disappointed when Biden couldn’t follow through on his pledge to cancel $10,000 to $20,000 in debt last year after the U.S. Supreme Court overturned his sweeping debt relief policy for 43 million Americans.

Biden’s continued efforts to cancel debt in a more piecemeal fashion have now reached nearly 4.75 million borrowers, which Biden continues to highlight on the campaign trail.

Three percent of the debt relief issued by the Biden administration has been through the SAVE Plan, while the vast majority has been through fixes to programs like Public Service Loan Forgiveness and income-driven repayment plans, which were plagued by administrative failures. The administration has also gone after colleges that have defrauded students, distributing widespread debt relief to the victims.

The administration is continuing to work on a Plan B to Biden’s initial, widespread debt relief proposal, taking a narrower approach that could cancel debt for about 30 million people in total, including the people who’ve already had debts canceled.

The administration hopes this more bureaucratic approach will not be overturned by the court yet again – though it is almost certain to face lawsuits once it reaches its final stages this summer.

President Joe Biden scored a temporary win in his efforts to provide relief to struggling student loan borrowers as a federal judge recently allowed his student loan repayment plan to proceed. This decision comes as a relief to the millions of Americans who have been burdened by student loan debt, especially during the ongoing economic challenges brought on by the COVID-19 pandemic.

The Biden administration had proposed a plan to streamline the process for borrowers to apply for loan forgiveness based on their income levels. This plan would allow borrowers to have their monthly payments capped at 10% of their discretionary income and have their loans forgiven after 20 years of consistent payments. The administration argued that this plan would provide much-needed relief to borrowers who are struggling to make ends meet and would help stimulate the economy by allowing individuals to invest in other areas such as buying homes or starting businesses.

However, the plan faced legal challenges from several states, including Texas, which argued that the administration did not have the authority to implement such a plan without congressional approval. The federal judge’s decision to allow the plan to proceed is seen as a significant victory for the Biden administration and a step forward in its efforts to provide relief to student loan borrowers.

While this decision is a positive development for borrowers, it is important to note that it is only a temporary win. The legal challenges against the plan are likely to continue, and it remains to be seen how the courts will ultimately rule on the matter. In the meantime, borrowers should continue to stay informed about their options for student loan repayment and take advantage of any relief programs that may be available to them.

Overall, the decision to allow President Biden’s student loan repayment plan to proceed is a positive development for borrowers who are struggling with student loan debt. It is a step in the right direction towards providing much-needed relief to individuals who are burdened by high levels of debt and are looking for ways to manage their financial obligations. As the legal challenges continue, borrowers should stay informed and explore all available options for student loan repayment.