WASHINGTON — The White House is signaling an openness to blocking the acquisition of U.S. Steel by Nippon Steel, as a government review of the proposed takeover by the Japanese company is on the cusp of ending.

The Washington Post reported Wednesday that President Joe Biden plans to stop the deal from going forward. A White House official, insisting on anonymity to discuss the matter, did not deny the report and said Biden still needs to receive the official recommendation from the Committee on Foreign Investment in the United States. That review could end as soon as this month.

Biden had already voiced his objections to the merger, backing his supporters in the United Steelworkers union who oppose the deal. The objection carries weight as U.S. Steel is headquartered in the swing state of Pennsylvania and is a symbol of Pittsburgh’s industrial might in an election year where Republicans and Democrats alike are promising more domestic manufacturing jobs.

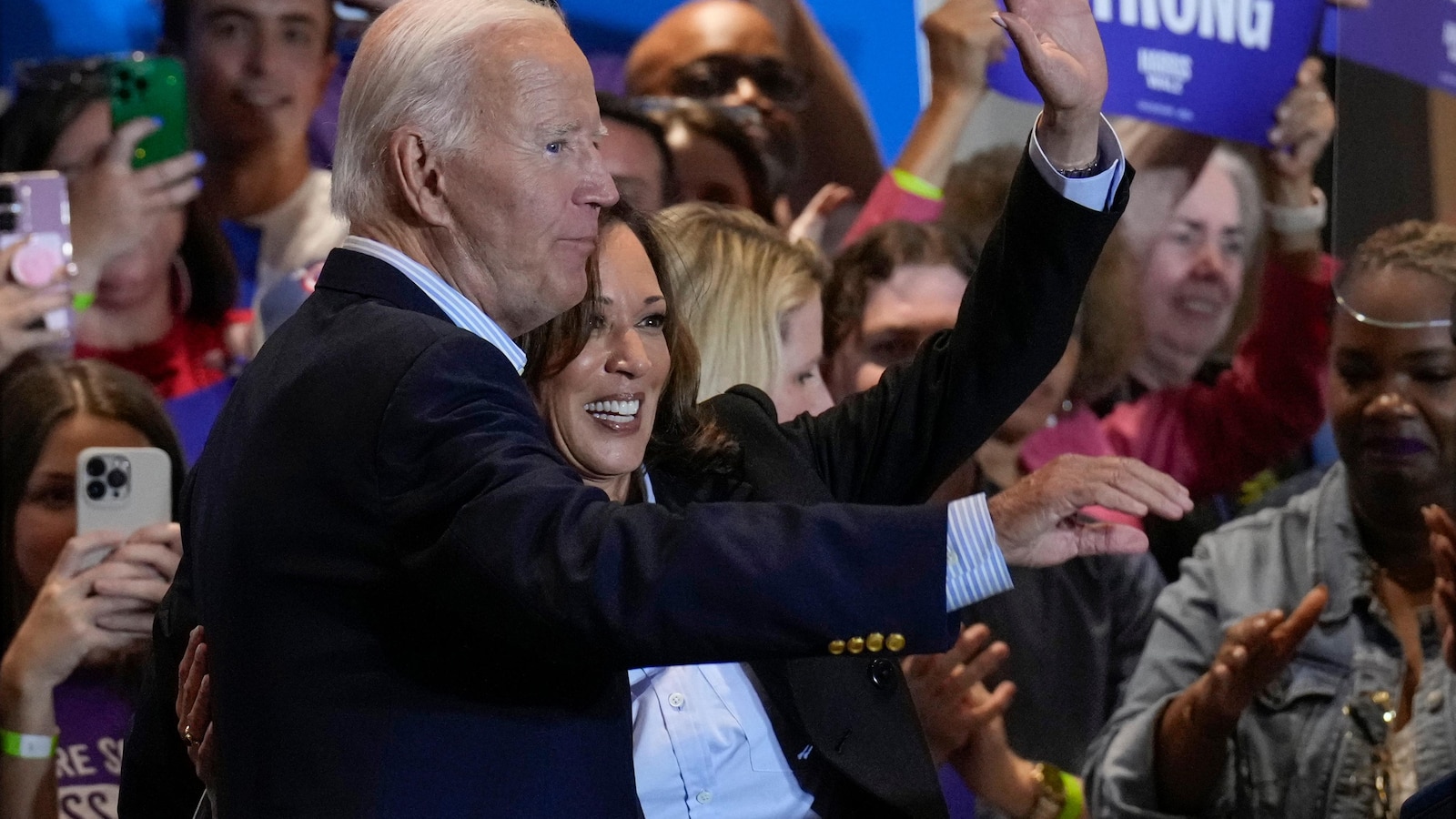

Vice President Kamala Harris, the Democratic nominee, came out against the deal this week. Former President Donald Trump, the Republican nominee, already said he would block the merger if he was still in the White House.

Stock in U.S. Steel fell roughly 17% on the news that Biden would stop the merger.

The CFIUS review process generally pertains to business issues with national security implications. U.S. Steel spokesperson Amanda Malkowski said in an email that the company had not received any update on the process and that the company sees “no national security issues associated with this transaction, as Japan is one of our most staunch allies.”

“We fully expect to pursue all possible options under the law to ensure this transaction, which is best future for Pennsylvania, American steelmaking, and all of our stakeholders, closes,” Malkowski said.

The company on Wednesday hosted a rally in support of the acquisition. It said in a statement that without the Nippon Steel deal the company would “largely pivot away from its blast furnace facilities, putting thousands of good-paying union jobs at risk, negatively impacting numerous communities across the locations where its facilities exist, and depriving the American steel industry of an opportunity to better compete on the global stage.”

Nippon Steel announced the deal in December 2023 and U.S. Steel shareholders approved it in April of this year.

___

Levy reported from Harrisburg, Pennsylvania.

The White House recently made headlines by indicating that it may block Nippon Steel’s proposed acquisition of US Steel, citing national security concerns. This move has sparked debate and speculation about the potential implications for both companies and the broader steel industry.

Nippon Steel, one of Japan’s largest steelmakers, announced its intention to acquire US Steel in a deal worth billions of dollars. The acquisition would have given Nippon Steel a significant foothold in the US market, allowing it to expand its global reach and compete more effectively with other major players in the industry.

However, the White House’s decision to potentially block the deal has raised questions about the motives behind the move. Some experts believe that the administration may be concerned about the impact of the acquisition on US national security, particularly in light of the ongoing trade tensions between the US and Japan.

The steel industry is a critical sector for any country, as it plays a key role in infrastructure development, defense manufacturing, and other strategic industries. The US has long been a major player in the global steel market, but has faced challenges in recent years due to competition from foreign producers and changing market dynamics.

The potential block of Nippon Steel’s acquisition of US Steel could have far-reaching consequences for both companies. For Nippon Steel, the deal represented a significant opportunity to expand its presence in the US market and strengthen its position as a global leader in the industry. If the acquisition is blocked, Nippon Steel may need to reassess its growth strategy and look for other ways to achieve its objectives.

On the other hand, US Steel could also be impacted by the White House’s decision. The company has faced challenges in recent years due to competition from foreign producers and changing market conditions. The acquisition by Nippon Steel could have provided US Steel with much-needed resources and expertise to remain competitive in the global market.

Overall, the potential block of Nippon Steel’s acquisition of US Steel highlights the complex interplay between business interests and national security concerns. As the steel industry continues to evolve and face new challenges, it will be important for companies to navigate these issues carefully and consider the broader implications of their strategic decisions.