California Considering New Rules for Property Insurance Pricing in Wildfire-Prone Areas

California, known for its picturesque landscapes and beautiful weather, has unfortunately also become synonymous with devastating wildfires. In recent years, the state has witnessed an alarming increase in the frequency and intensity of wildfires, causing significant damage to homes and properties. As a result, property insurance rates have skyrocketed, making it increasingly difficult for homeowners in wildfire-prone areas to afford coverage. In response to this growing concern, California is considering implementing new rules for property insurance pricing in these high-risk regions.

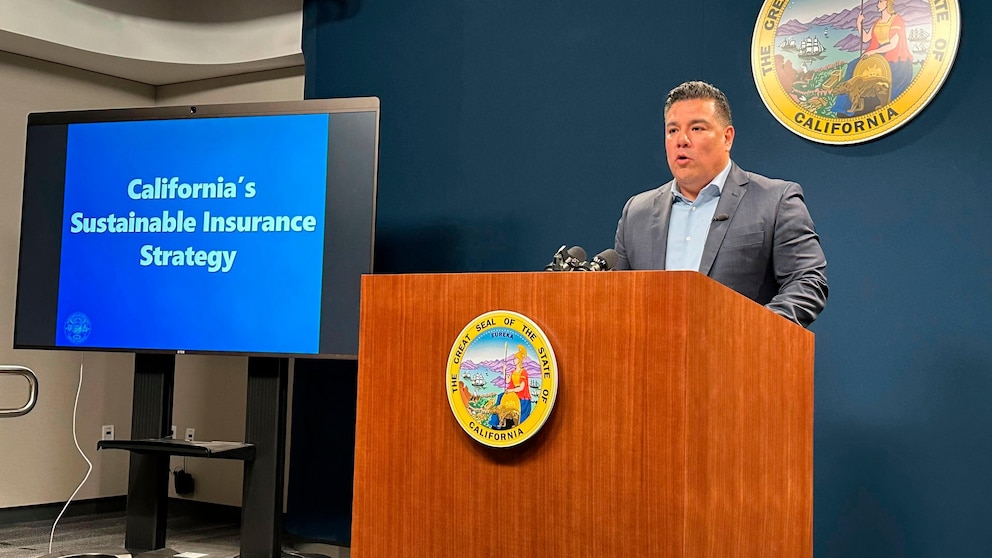

The proposed regulations aim to address the issue of affordability and accessibility of property insurance in wildfire-prone areas. The California Department of Insurance is leading the charge in developing these rules, which would require insurance companies to justify any rate increases and ensure that they are based on accurate and up-to-date risk assessments.

One of the key factors contributing to the rising insurance rates is the lack of available data on wildfire risk. Traditionally, insurance companies have relied on historical data to assess risk and determine premiums. However, with the increasing unpredictability and severity of wildfires, this approach is no longer sufficient. The new rules would require insurers to incorporate advanced modeling techniques that take into account factors such as climate change, vegetation management, and fire suppression efforts.

Another important aspect of the proposed regulations is transparency. Insurance companies would be required to disclose information about their risk assessment models and explain how they calculate premiums. This would enable homeowners to better understand the factors influencing their insurance rates and make informed decisions about their coverage options.

The California Department of Insurance is also exploring the possibility of creating a statewide pool or a publicly funded entity that would provide coverage for homeowners who are unable to obtain insurance in high-risk areas. This would ensure that all residents have access to affordable coverage, regardless of their location.

While these proposed rules are still under review, they have received support from various stakeholders, including consumer advocacy groups and lawmakers. However, some insurance industry representatives argue that the regulations could lead to unintended consequences, such as a reduction in the availability of coverage or an increase in premiums for policyholders in low-risk areas.

Nevertheless, the urgency to address the issue of property insurance affordability in wildfire-prone areas cannot be ignored. The devastating consequences of wildfires have left many homeowners financially vulnerable and struggling to rebuild their lives. By implementing these new rules, California aims to strike a balance between protecting consumers and ensuring the stability of the insurance market.

In conclusion, California’s consideration of new rules for property insurance pricing in wildfire-prone areas is a significant step towards addressing the affordability and accessibility challenges faced by homeowners. By incorporating advanced risk assessment techniques and promoting transparency, these regulations aim to provide fair and affordable coverage options for all residents. As the state continues to grapple with the increasing threat of wildfires, it is crucial to find sustainable solutions that protect both homeowners and the insurance industry.