Title: Challenges Arise for State Tax Cutting Trend Amid Decreasing Revenues and Constrained Budgets

Introduction:

In recent years, a growing number of states across the United States have embraced the trend of tax cuts as a means to stimulate economic growth and attract businesses. However, the current economic climate, characterized by decreasing revenues and constrained budgets, has presented significant challenges to this popular approach. As states grapple with the need to balance their budgets while providing essential services, the feasibility and effectiveness of tax cuts are being called into question.

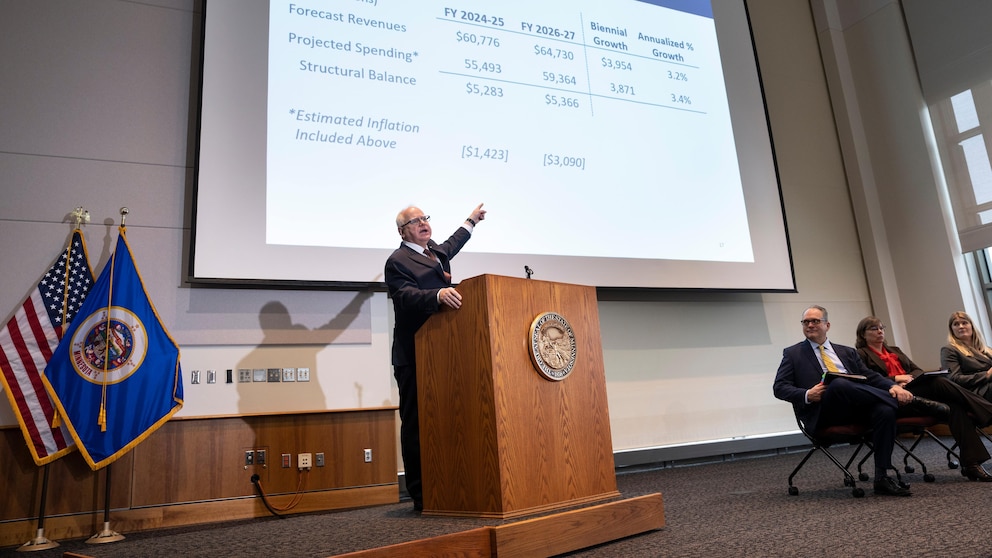

1. Decreasing Revenues:

One of the primary challenges faced by states looking to implement tax cuts is the decline in revenue streams. The COVID-19 pandemic has had a profound impact on state economies, leading to reduced tax collections from various sources such as income, sales, and tourism. This decline in revenue has left many states struggling to meet their existing financial obligations, let alone consider implementing tax cuts.

2. Constrained Budgets:

Constrained budgets further compound the challenges associated with tax cutting trends. States are often required to allocate funds for essential services such as education, healthcare, infrastructure, and public safety. With limited resources available, any reduction in tax revenue can strain these critical sectors, potentially leading to cuts in services or increased borrowing.

3. Balancing Fiscal Responsibility:

While tax cuts may be politically popular, policymakers must carefully weigh the potential benefits against the risks of exacerbating budget deficits. Implementing tax cuts without corresponding spending reductions can result in a widening gap between revenue and expenditure, leading to long-term fiscal instability. Maintaining fiscal responsibility becomes crucial in times of economic uncertainty.

4. Unequal Distribution of Benefits:

Another challenge associated with tax cutting trends is the unequal distribution of benefits. Critics argue that tax cuts tend to disproportionately benefit higher-income individuals and corporations, exacerbating income inequality. This can further strain social safety nets and hinder efforts to address pressing societal issues such as poverty and access to healthcare.

5. Uncertain Economic Impact:

The effectiveness of tax cuts in stimulating economic growth remains a subject of debate. While proponents argue that reduced taxes can incentivize business investment and consumer spending, detractors contend that the impact on economic growth is often minimal. The success of tax cuts in generating sustainable economic benefits largely depends on various factors such as the state’s economic structure, industry composition, and overall business environment.

6. Long-term Revenue Implications:

Implementing tax cuts without a comprehensive plan for revenue replacement can have long-term implications for states’ financial health. Reduced tax revenues may necessitate future tax increases or spending cuts to compensate for the lost revenue, potentially creating a cycle of fiscal instability. States must carefully consider the long-term consequences before embarking on tax cutting trends.

Conclusion:

While tax cuts have been a popular trend among states seeking to stimulate economic growth, the current economic climate presents significant challenges to their implementation. Decreasing revenues and constrained budgets make it increasingly difficult for states to balance fiscal responsibility with the desire for tax relief. Policymakers must carefully evaluate the potential benefits and risks associated with tax cuts, ensuring that any measures taken are sustainable and equitable in the long run.