As the clock strikes midnight, many of the world’s poorest countries are facing a looming debt crisis, with China’s loans being a major contributor to the problem. China has become a major lender to developing countries, offering loans for infrastructure projects and other development initiatives. However, these loans often come with high interest rates and strict repayment terms that can push countries into a cycle of debt and economic instability.

China’s lending practices have come under scrutiny in recent years as more and more countries struggle to repay their debts. Many of these loans are tied to specific projects, such as ports, railways, and power plants, which can be expensive to build and maintain. When countries are unable to generate enough revenue from these projects to repay their loans, they can quickly fall into debt.

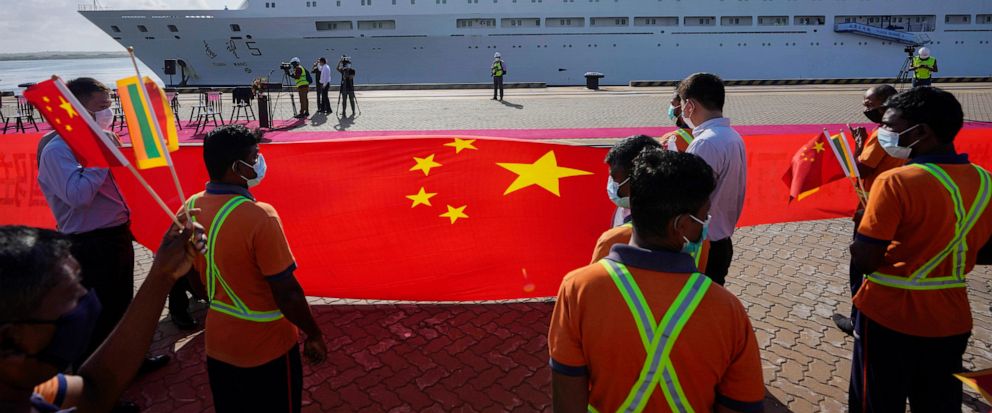

One of the most high-profile examples of this is Sri Lanka, which took out a $1.5 billion loan from China to build a new port in Hambantota. However, the port has struggled to attract enough business to generate revenue, leaving Sri Lanka struggling to repay its debt. In 2017, Sri Lanka was forced to hand over control of the port to China on a 99-year lease in order to help pay off its debt.

Other countries that have taken out large loans from China include Pakistan, Djibouti, and Angola. In many cases, these loans have been used to fund large infrastructure projects that are seen as crucial for economic development. However, the high interest rates and strict repayment terms attached to these loans can make it difficult for these countries to keep up with their payments.

The COVID-19 pandemic has only exacerbated this problem, with many developing countries facing economic downturns and struggling to generate enough revenue to repay their debts. The International Monetary Fund (IMF) has warned that many of these countries are at risk of defaulting on their loans, which could have serious consequences for their economies and for global financial stability.

Some experts have called for greater transparency and accountability in China’s lending practices, arguing that countries should be given more information about the terms of their loans and the potential risks involved. Others have suggested that international organizations like the IMF should play a greater role in monitoring and regulating these loans.

Whatever the solution, it is clear that the issue of China’s loans to developing countries is a complex and pressing one that requires urgent attention. As the clock strikes midnight, many of these countries are facing an uncertain future, with their economies and their people at risk of collapse. It is up to the international community to work together to find a way forward that is fair, sustainable, and equitable for all.