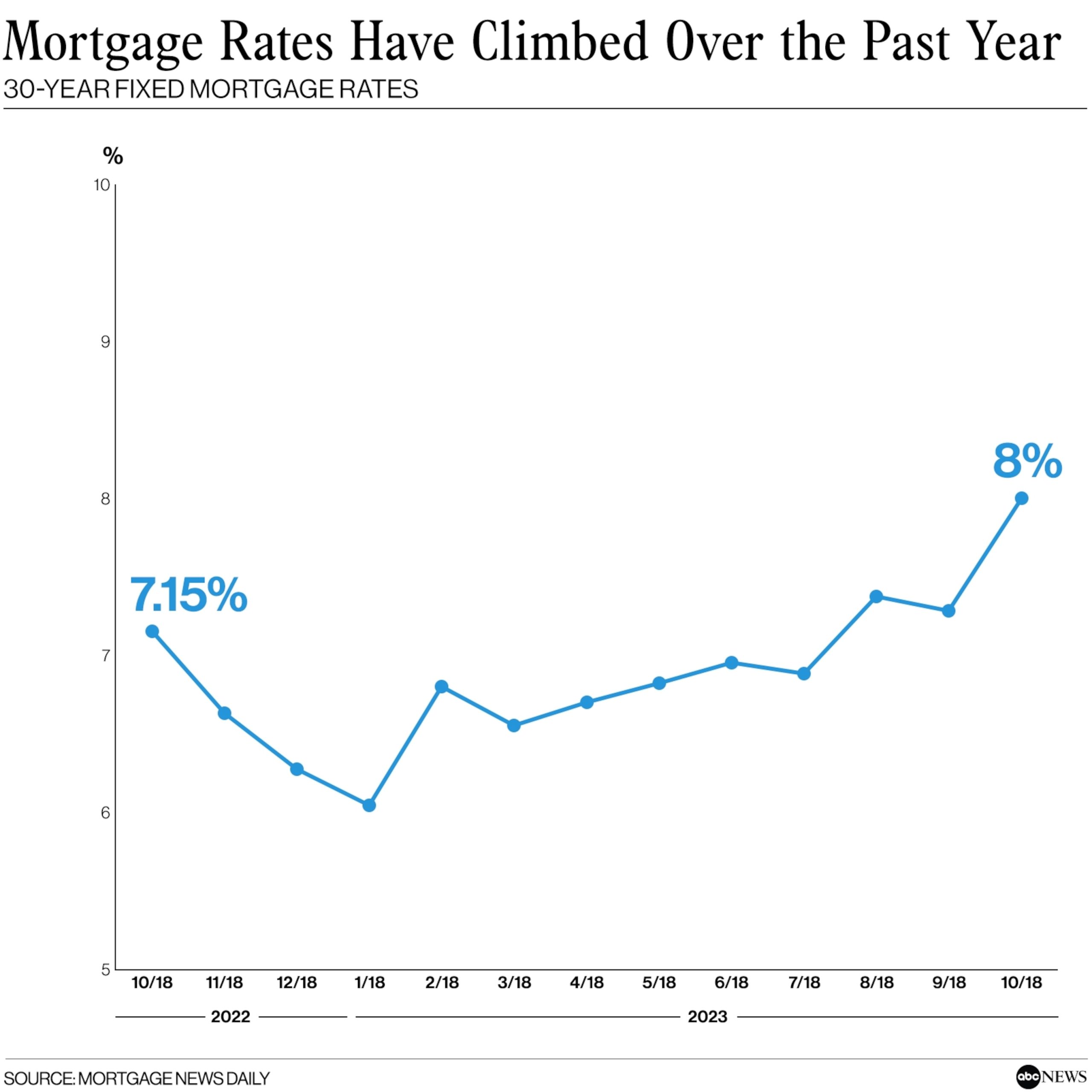

For the first time since 2000, mortgage rates have reached 8%, marking a significant milestone in the housing market. This increase in rates has caught the attention of potential homebuyers and homeowners alike, as it may impact their ability to afford a new home or refinance their existing mortgage.

Mortgage rates are influenced by several factors, including the overall health of the economy, inflation rates, and the decisions made by the Federal Reserve. In recent years, mortgage rates have been historically low, hovering around 3-4%. However, as the economy continues to recover from the impact of the COVID-19 pandemic, interest rates have started to rise.

The increase in mortgage rates to 8% has raised concerns among prospective homebuyers who were hoping to take advantage of the low rates. Higher interest rates mean higher monthly mortgage payments, which can make it more challenging for individuals and families to afford a new home. This may lead to a slowdown in the housing market, as potential buyers may be deterred by the increased cost of borrowing.

Additionally, homeowners who were considering refinancing their mortgages may also be affected by these higher rates. Refinancing allows homeowners to take advantage of lower interest rates to reduce their monthly payments or shorten the term of their loan. However, with rates reaching 8%, the potential savings from refinancing may not be as significant, making it less appealing for homeowners to pursue this option.

While the increase in mortgage rates may pose challenges for homebuyers and homeowners, it is important to note that rates are still historically low compared to previous decades. In the 1980s, for example, mortgage rates reached as high as 18%, making homeownership much more expensive. Therefore, even with rates at 8%, buying a home or refinancing a mortgage can still be a viable option for many individuals.

It is also worth mentioning that higher mortgage rates can have a positive effect on the overall economy. When interest rates rise, it can help to curb inflation and prevent the economy from overheating. This can be beneficial in the long run, as it promotes a more stable and sustainable economic environment.

For potential homebuyers and homeowners who are concerned about the impact of higher mortgage rates, there are several strategies that can be considered. First, it is important to shop around and compare rates from different lenders to ensure you are getting the best deal possible. Additionally, working on improving your credit score can help you qualify for lower interest rates. Finally, considering alternative loan options, such as adjustable-rate mortgages or shorter loan terms, may also be worth exploring.

In conclusion, the recent increase in mortgage rates to 8% marks a significant change in the housing market. While it may pose challenges for homebuyers and homeowners, it is important to keep in mind that rates are still historically low compared to previous decades. By exploring different strategies and options, individuals can still find ways to navigate the changing interest rate environment and achieve their homeownership goals.