JPMorgan Agrees to Allocate $75 Million to Victims’ Fund in Jeffrey Epstein Settlement

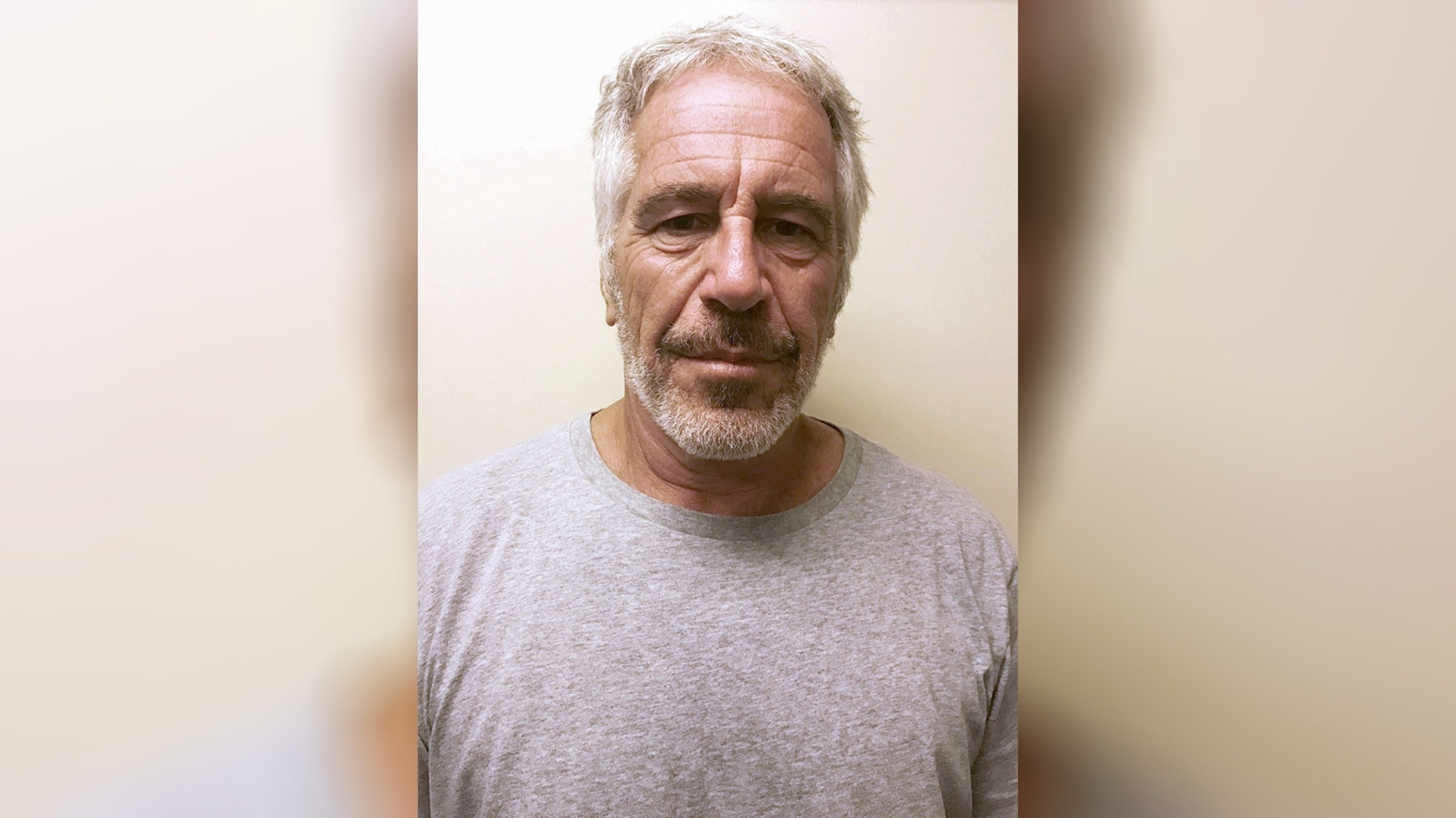

In a significant development, JPMorgan Chase, one of the largest banks in the United States, has agreed to allocate $75 million to a victims’ fund as part of a settlement related to its dealings with the late financier Jeffrey Epstein. The settlement aims to compensate victims who suffered abuse at the hands of Epstein, who was arrested in 2019 on charges of sex trafficking and conspiracy.

Epstein’s case garnered worldwide attention due to his connections with numerous high-profile individuals, including politicians, businessmen, and celebrities. His alleged crimes involved exploiting underage girls for sexual purposes, and he was awaiting trial when he died by suicide in his jail cell in August 2019.

The settlement with JPMorgan Chase comes after an investigation by the U.S. Department of Justice (DOJ) into the bank’s relationship with Epstein. The DOJ found that the bank had failed to properly monitor Epstein’s suspicious financial transactions, despite being aware of his criminal history and the risks associated with him as a client.

As part of the settlement, JPMorgan Chase has agreed to pay a $75 million fine, which will be used to establish a fund for Epstein’s victims. The bank has also committed to enhancing its anti-money laundering controls and implementing stricter protocols for monitoring high-risk clients.

This settlement is a significant step towards providing justice and compensation for Epstein’s victims. It acknowledges the bank’s failure to prevent financial transactions that may have facilitated Epstein’s illegal activities. By allocating a substantial amount to the victims’ fund, JPMorgan Chase is taking responsibility for its role in enabling Epstein’s actions and attempting to rectify the harm caused.

The establishment of the victims’ fund will provide financial support to those who suffered abuse at the hands of Epstein. It will help them access resources such as therapy, medical care, and other necessary services to aid in their recovery. The fund will be administered independently, ensuring that the victims receive the compensation they deserve without any conflicts of interest.

JPMorgan Chase’s commitment to improving its anti-money laundering controls is also a crucial aspect of this settlement. It highlights the need for financial institutions to be vigilant in monitoring their clients’ activities, especially when there are red flags indicating potential criminal behavior. Strengthening these controls will not only help prevent similar incidents in the future but also contribute to the overall fight against money laundering and illicit activities.

However, it is important to note that this settlement does not absolve JPMorgan Chase of its responsibilities entirely. The bank still faces ongoing investigations by other regulatory bodies, including the Securities and Exchange Commission (SEC) and the Federal Reserve. These investigations will determine whether further penalties or corrective actions are necessary to ensure the bank’s compliance with regulations and prevent similar failures in the future.

The settlement between JPMorgan Chase and the victims’ fund represents a significant milestone in the pursuit of justice for Epstein’s victims. It serves as a reminder that financial institutions must exercise due diligence in their client relationships and take appropriate action when suspicious activities arise. By allocating a substantial amount to compensate the victims and committing to stronger anti-money laundering controls, JPMorgan Chase is taking steps towards rectifying its past mistakes and preventing future ones.